work opportunity tax credit questionnaire on job application

Keystone Opportunity Zone Tax Credit. The traditional collection of paper based forms completion of monthly and annual returns and even the familiar C2 card or C2 Authorisation has now been replaced by the new online eRCT compliance system with effect from 1 January 2012.

Resolve bills or liens for work done by the City on a property.

. The state tax credit is equal to 25 percent of the amount an owner claims under the federal program. It is a great place to work with an. You will need to file an application show that you meet the minimum qualifications as defined by the job announcement and then go through an examination process.

If you start an application for another job your new details will be used. That is a potential of up to 5000 per employee. For instance when a job applicant responds to a job posting we will share your personal data with the employer in order to facilitate the job search and hiring process.

There is no application process for the state tax credit beyond the successful applicants own state income tax forms. One year of experience refers to full-time work. Employment is a relationship between two parties regulating the provision of paid labour services.

Scroll down and locate your job application. To ensure full credit for your work experience please indicate dates of employment by monthyear and indicate number of hours worked per week on your resume. In 2020 a credit is available up to 5000 per employee from 31220-123120 by an eligible employer.

The ERTC program is a refundable tax credit for business owners in 2020 and 2021. Job Creation Tax Credit. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work.

The Relevant contracts tax compliance system has undergone a complete transformation. Provisional Appointments When a department needs to fill a vacancy that is covered by the civil service process but no applicant pool of eligible employees is available departments. The Equal Credit Opportunity Act ECOA is a federal law preventing lending discrimination based on factors unrelated to a persons ability to.

Our current opening hours are 0800 to 1800 Monday to Friday and 1000 to 1700 Saturday. Office of Chief Counsel IRS is looking for enthusiastic individuals to join our team and gain valuable experience in a legal environment. ERCT Compliance System 2012.

Take the survey to help us serve you better. You can do a search for the forms andor publications you need below. If your current or former employer uses one of our Services personal data you input into those Services is accessible by that employers end users - subject to the security.

Part-timework is considered on a prorated basis. Unable to access a job If youre a civil servant or an employee of. Use code enforcement numbers to request a payoff.

If emailing us please include your full name address including postcode and telephone number. How to Claim the Credit. Employees work in return for wages which can be paid on the basis of an.

If there is a form that youre looking for that you cant locate please email email protected and let us know. Once the job has been located click. General information Reference 000099 Publication start date 03062021 Job description GAP one Post description Admin Assistant Vacancy details Division Head Office - GAP One Title Credit Control Admin Assistant - Glasgow Contract type Permanent Full Time Vacancy location Location Scotland Scotland Glasgow Location Glasgow G2 8DA Employment Details Contract hours.

Our mission is to serve Americas taxpayers fairly and with integrity by providing correct and impartial interpretation of the internal revenue laws and the highest quality legal advice and representation for the IRS. The Department of Revenue has created a short questionnaire to gather feedback from customers.

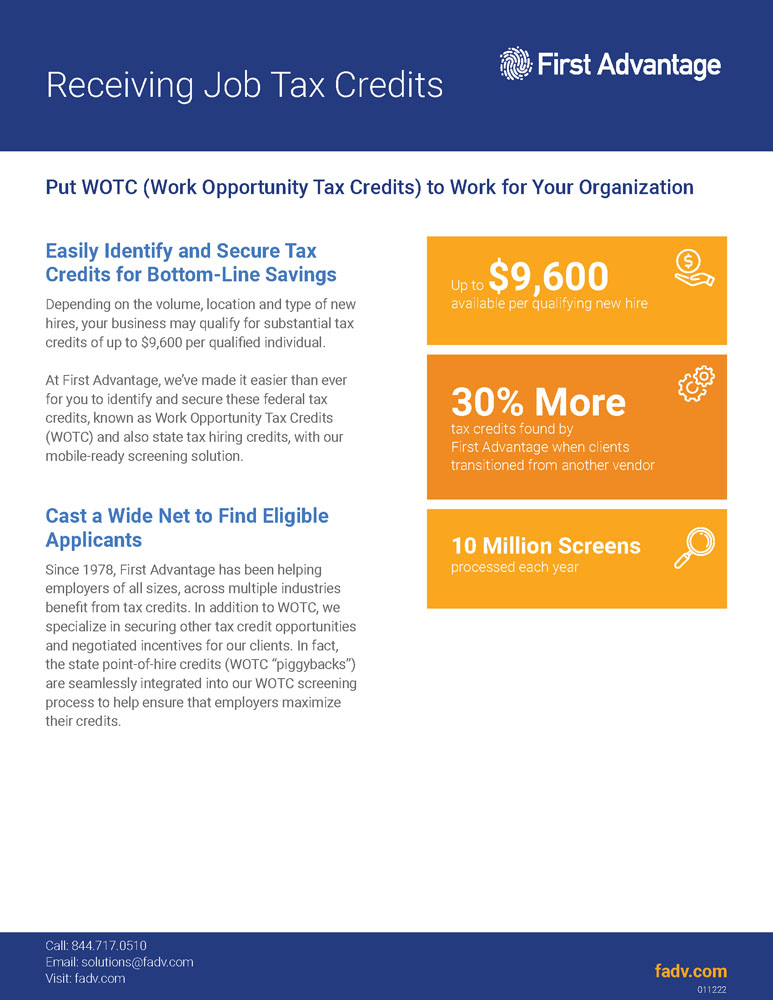

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

With Wotc Timing Is Everything Wotc Planet

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questions What Is The Work Opportunity Tax Credit Questionnaire Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

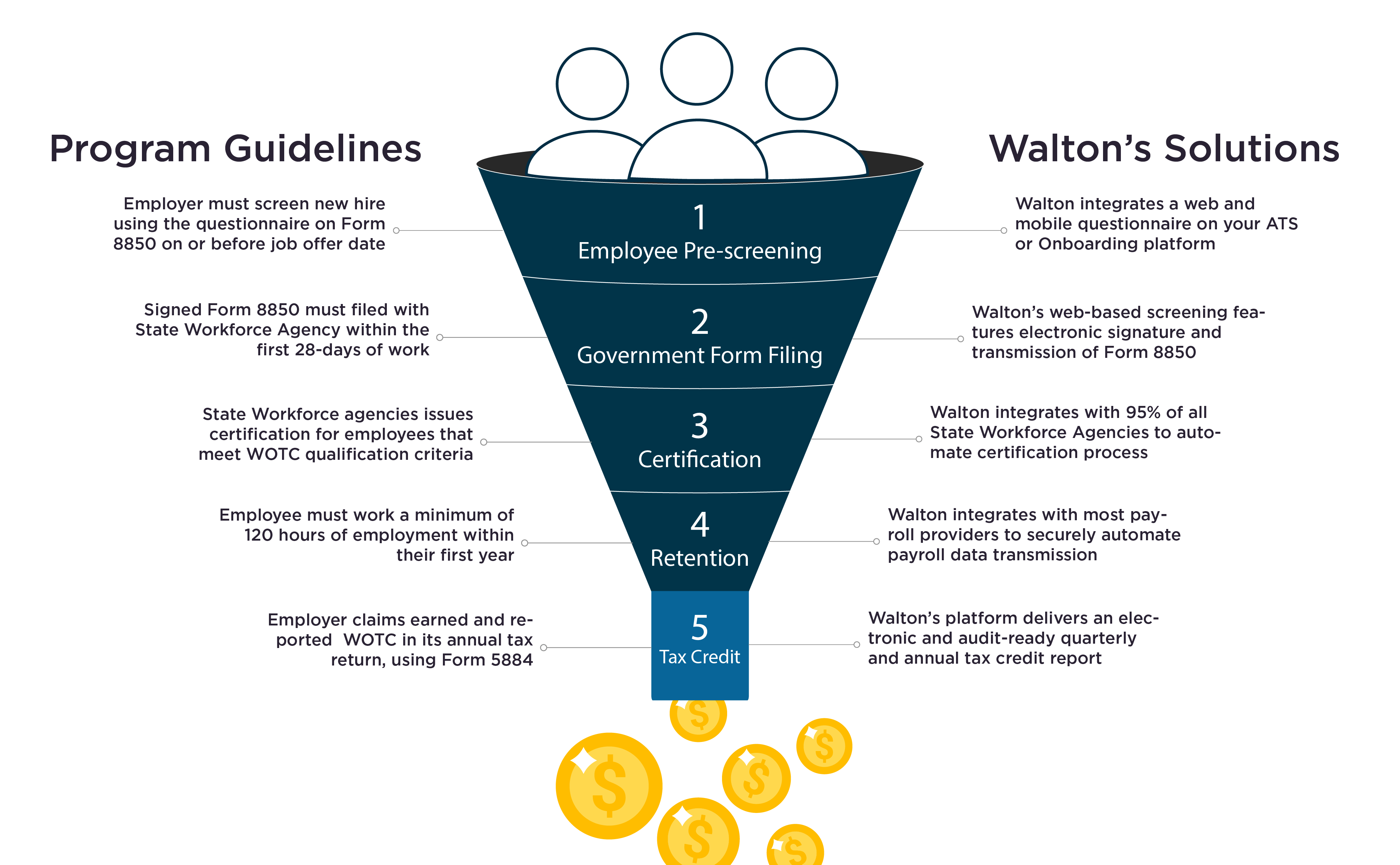

Work Opportunity Tax Credits Wotc Walton

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credits Wotc Walton

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com