what is suta tax california

No guidance yet. State unemployment tax is a percentage of an employees.

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

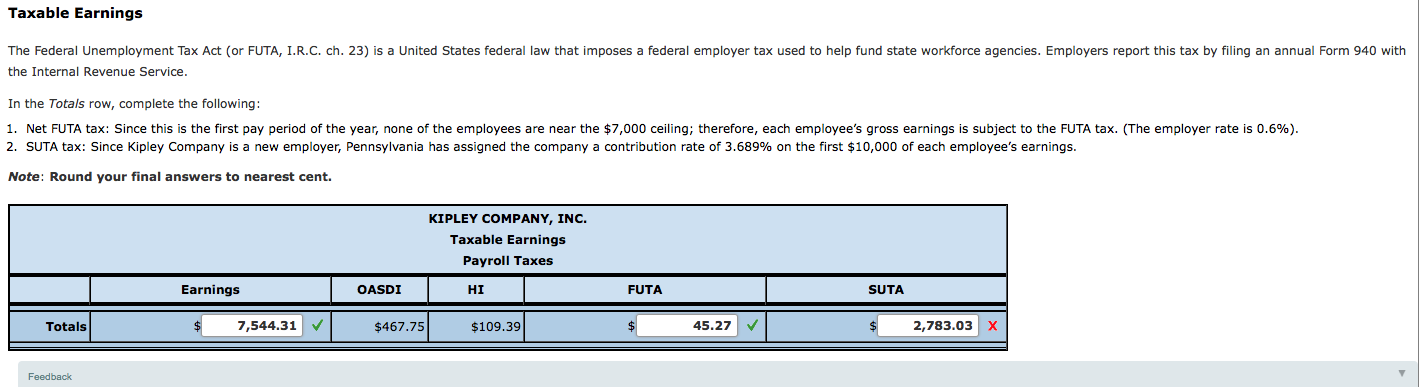

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

. What wages are subject to Suta. The tax rate for new employers is 17. SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates.

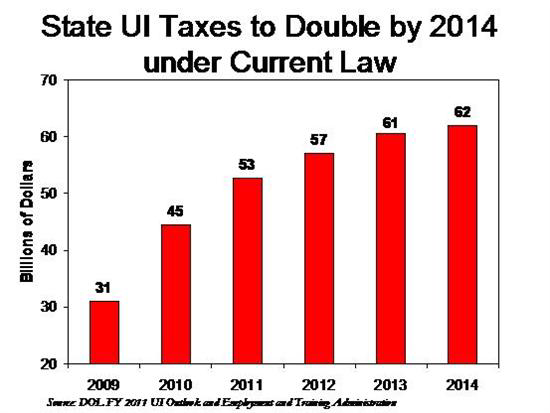

In 2018 the trust fund regained a positive balance after nine years of insolvency. These benefits are provided to qualifying employees by the state to assist in compensation for loss in employment. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

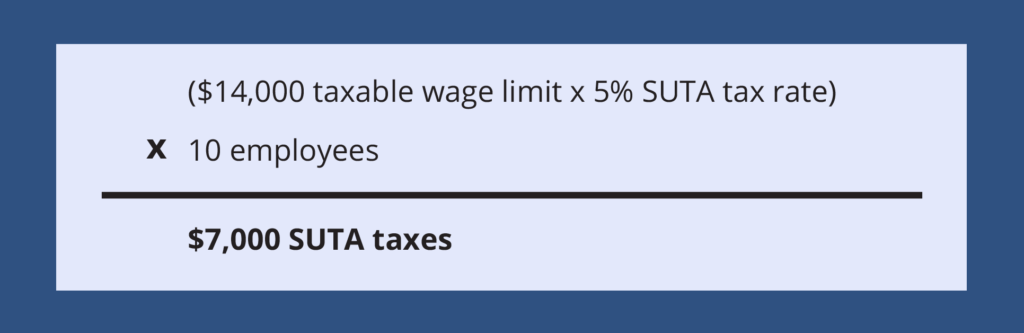

The taxable wage limit is 145600 for each employee per calendar year. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. 2020 SUI tax rates and taxable wage base.

For 2020 the taxable wage base or taxable wage limit in California is7000 per employee and the average SUTA tax is 34. Either way the money generated from the tax goes into a fund that is administered by the state within guidelines established by federal law. In some cases however the employee may also have to pay SUTA taxes.

SUTA stands for State Unemployment Tax Act. For an employee to receive unemployment benefits through the state they must be eligible. The new employer SUI tax rate remains at 34 for 2021.

Also employers should be aware of certain occasions that require them to pay FUTA and SUTA. Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers. For example the wage base limit in California is 7000.

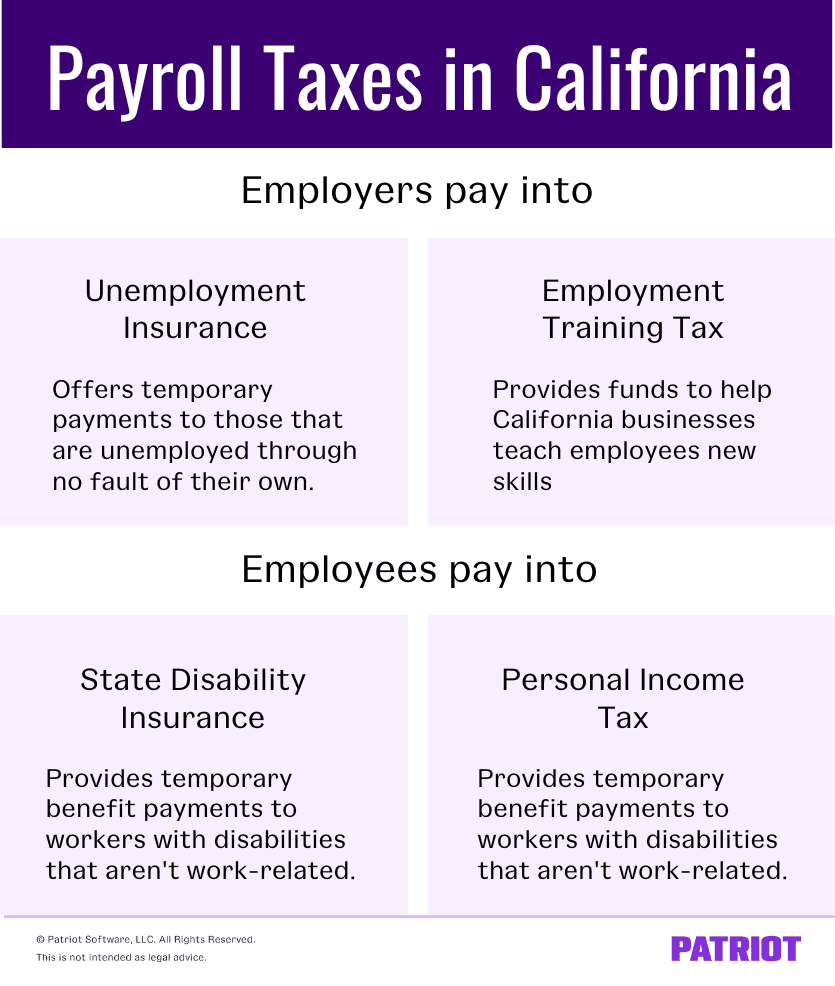

The employee pays for disability insurance through withholding meaning the employer deducts the payment from his or her wages. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. The SUI rate schedule is expected to remain F for the foreseeable future.

Who pays Suta in California. This means that if you qualify for the highest credit expect 06 as the net rate. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge.

Paying employees at least 1500 during a current or previous calendar quarter. California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the. State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages.

Californias state unemployment insurance or SUI is an employer-paid tax. What is California tax rate for payroll. Also you can only pay a minimum amount of.

See Determining Unemployment Tax Coverage. The new employer SUI tax rate remains at 34 for 2020. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. Each state establishes its own tax rate and wage base. Using the formula below you would be required to pay 1458 into your states unemployment fund.

While there will be an increase in the state disability insurance taxable wage base from 128298 in 2021 to 145600 in 2022 the tax rate associated with this program will decrease from 120 in 2021 to 110 in 2022. New Hampshire has raised its unemployment tax rates for the second quarter of 2020. That means that in 2020 youll pay.

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes. Here is how to do your calculation.

5 of 7000 350 350 x 3 1050 You will pay 1050 in SUI. The SUI taxable wage base for 2020 remains at 7000 per employee. California has four state payroll taxes.

How FUTA Affects SUTA. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the lower rate. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. 7000 per employee x 3 employees x 34 714 in SUTA tax SUTA rates.

Unlike Social Security and Medicare employees dont share this tax liability with their employers. As mentioned above SUTA gives employers a tax credit of upto 54 only if they make payment on time and in full. A typical SUTA rate ranges from 2-4.

State disability insurance or SDI is an employee-paid tax. Employer Contributions Most employers are tax-rated employers and pay UI taxes based on their UI rate. SUTA is short for State Unemployment Tax Act.

The fund pays unemployment benefits to employees who have become unemployed at no fault of their own. Californias unemployment taxable wage base is to be 7000 in 2022 unchanged from 2021. How do I find out the wage base limit in my state and the tax rate for my business.

Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. The SDI withholding rate for 2022 is 110 percent. This tax is a payroll tax that businesses must pay to fund unemployment benefits.

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

State Unemployment Tax Act Suta Bamboohr

What S The Cost Of Unemployment Insurance To The Employer

2022 Federal Payroll Tax Rates Abacus Payroll

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

How To Reduce Your Clients Suta Tax Rate In 2014

Understanding California Payroll Tax

What Is Sui State Unemployment Insurance Tax Ask Gusto

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

State Unemployment Tax Act Suta Bamboohr

What Is Sui State Unemployment Insurance Tax Ask Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Nanny Payroll Part 3 Unemployment Taxes

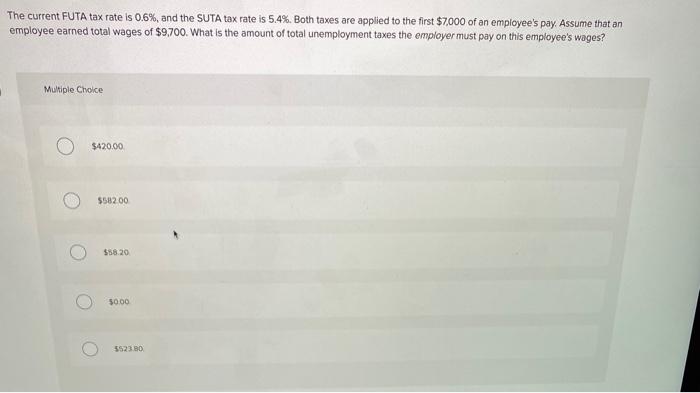

Solved The Current Futa Tax Rate Is 0 6 And The Suta Tax Chegg Com

What Is The Futa Tax 2022 Tax Rates And Info Onpay

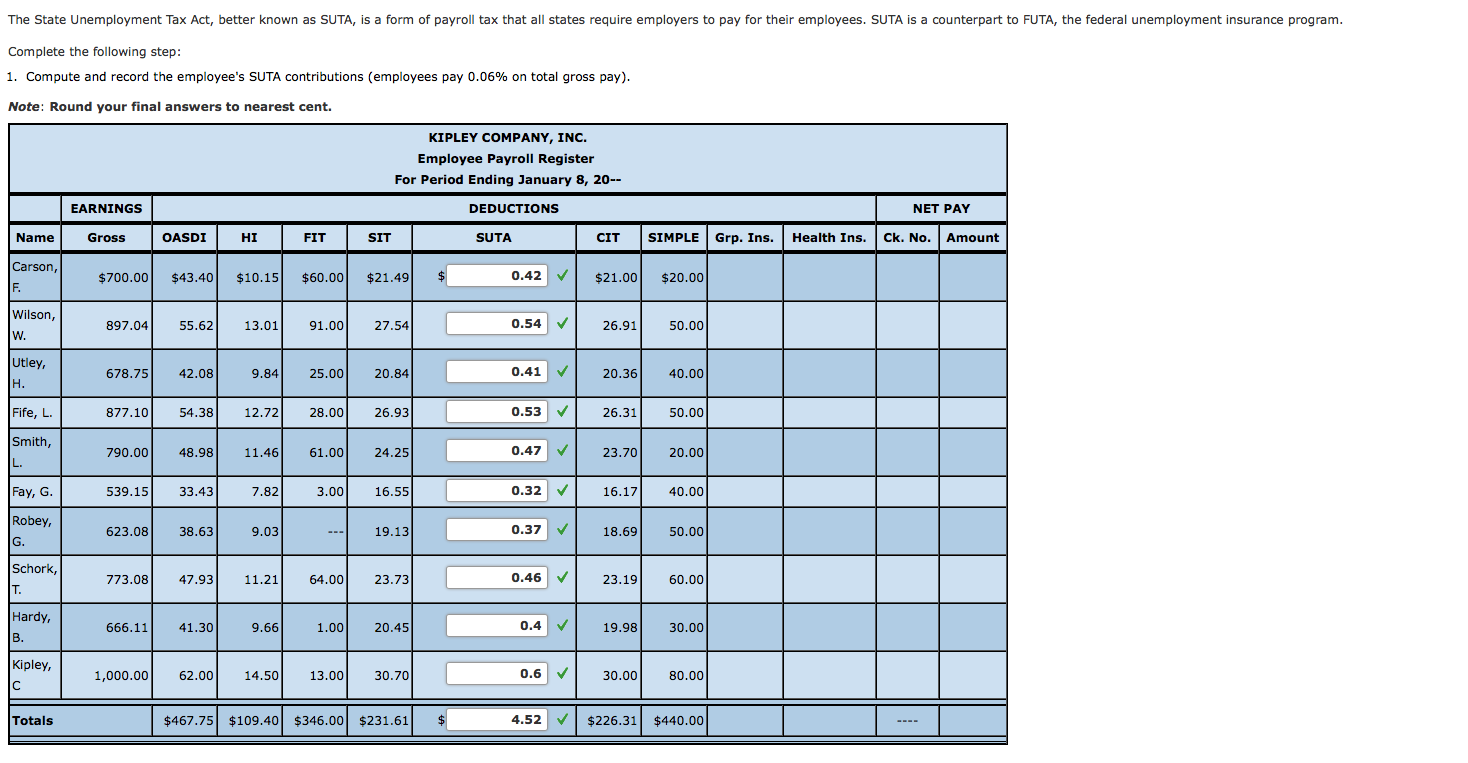

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

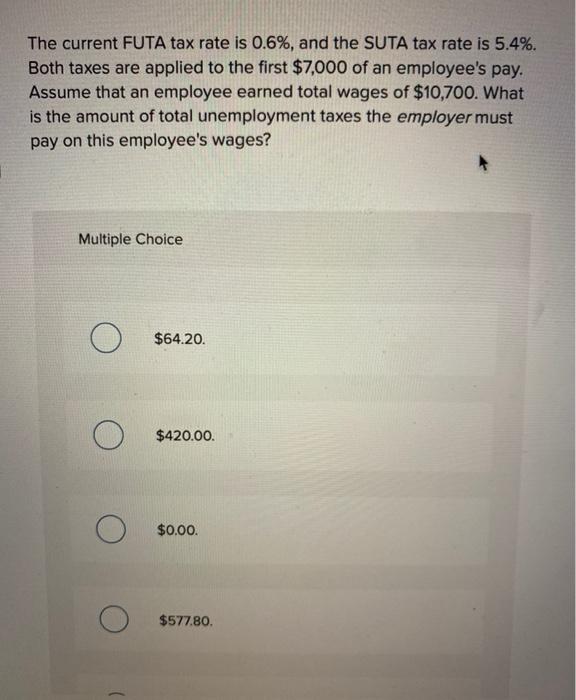

Solved The Current Futa Tax Rate Is 0 6 And The Suta Tax Chegg Com

Is There A Way To Find My Unemployment Id Number In The Platform